Note: This section contains information in English only.

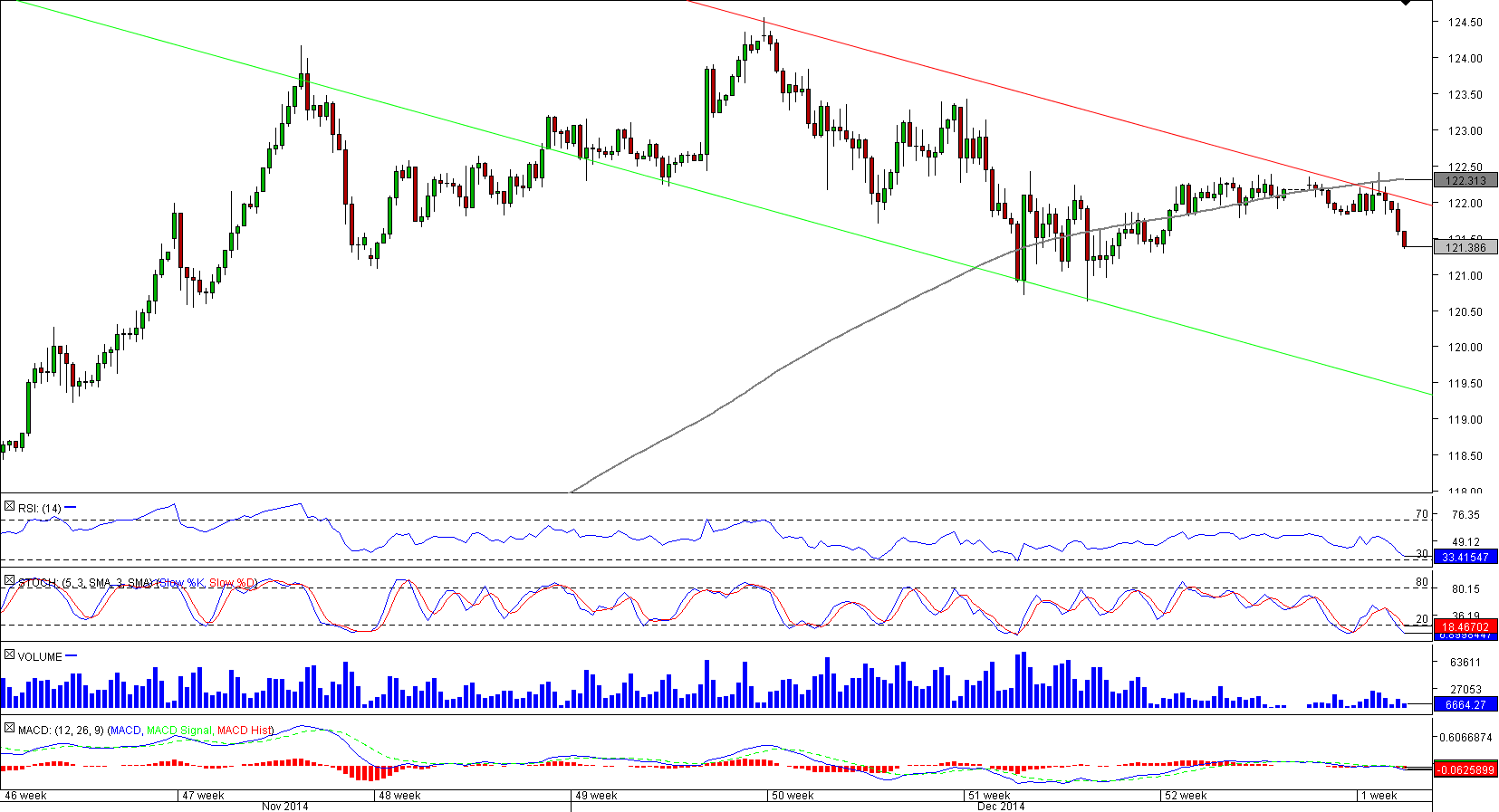

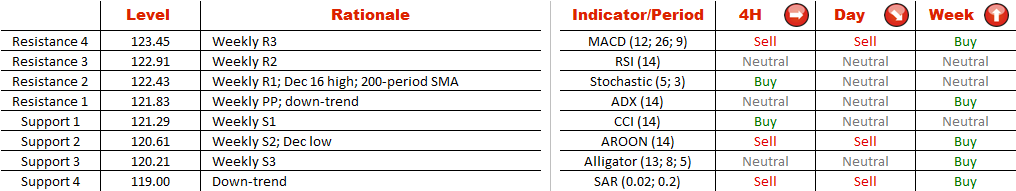

CHF/JPY has entered a correctional phase recently, following the Oct-Nov rally to 124.50. Right now the pair is trading at the 23.8% retracement of the latest up-move. But considering the bearishness of the technical indicators and toughness of the resistance at 122.40 (weekly R1, 200-period SMA, Dec 16 high and down-trend), the sell-off is expected to persist. A potential turning point is assumed to lie somewhere between 119.50 and 119, where the lower down-trend coincides with the 38.2% Fibonacci retracement. Meanwhile, the sentiment of the SWFX market is explicitly bearish—as many as 72% of open positions are short.

CHF/JPY has entered a correctional phase recently, following the Oct-Nov rally to 124.50. Right now the pair is trading at the 23.8% retracement of the latest up-move. But considering the bearishness of the technical indicators and toughness of the resistance at 122.40 (weekly R1, 200-period SMA, Dec 16 high and down-trend), the sell-off is expected to persist. A potential turning point is assumed to lie somewhere between 119.50 and 119, where the lower down-trend coincides with the 38.2% Fibonacci retracement. Meanwhile, the sentiment of the SWFX market is explicitly bearish—as many as 72% of open positions are short.

Tue, 30 Dec 2014 07:11:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.