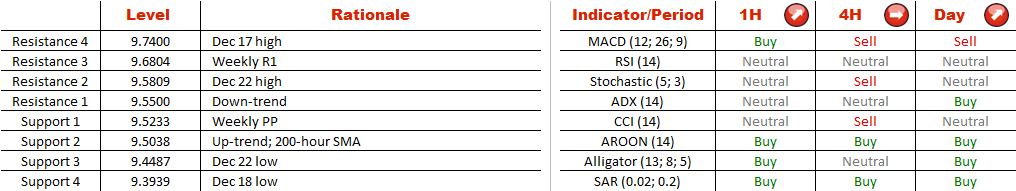

Once the falling resistance line at 9.55 is breached, the main target will be the Dec 22 high at 9.58. In case the bulls keep pushing the price higher, the weekly R1 at 9.68 and Dec at high at 9.74 may become the next objectives.

Note: This section contains information in English only.

Already since mid-December the trading range of EUR/SEK has been constantly narrowing, and this has led to formation of a symmetrical triangle. Considering the overall bullish tendency the pair has been exhibiting since this year's October and the signals provided by the technical indicators, a break-out to the upside appears to be a more probable scenario than violation of the support at 9.504.

Already since mid-December the trading range of EUR/SEK has been constantly narrowing, and this has led to formation of a symmetrical triangle. Considering the overall bullish tendency the pair has been exhibiting since this year's October and the signals provided by the technical indicators, a break-out to the upside appears to be a more probable scenario than violation of the support at 9.504.

Once the falling resistance line at 9.55 is breached, the main target will be the Dec 22 high at 9.58. In case the bulls keep pushing the price higher, the weekly R1 at 9.68 and Dec at high at 9.74 may become the next objectives.

Fri, 26 Dec 2014 07:02:12 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Once the falling resistance line at 9.55 is breached, the main target will be the Dec 22 high at 9.58. In case the bulls keep pushing the price higher, the weekly R1 at 9.68 and Dec at high at 9.74 may become the next objectives.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.