Note: This section contains information in English only.

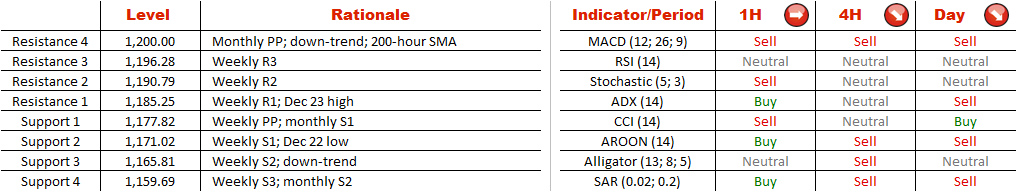

In the first half of December the bullion peaked out at 1,238 and since then it has been unable to regain a bullish momentum. Right now the fluctuations of XAU/USD are limited by two bearish trend-lines that are unlikely to let the price to rise above 1,200 but also it to fall beneath 1,166, at least in the short run. In the long run the gold retains a negative bias, a scenario which is confirmed by the four-hour and daily technical indicators. Nevertheless, a rally in the nearest future is more probable than a dip. If the Dec 23 high at 1,185 is surpassed, the metal will have a good opportunity to test a cluster of resistances at 1,200, created by the 200-hour SMA, monthly PP and the down-trend.

In the first half of December the bullion peaked out at 1,238 and since then it has been unable to regain a bullish momentum. Right now the fluctuations of XAU/USD are limited by two bearish trend-lines that are unlikely to let the price to rise above 1,200 but also it to fall beneath 1,166, at least in the short run. In the long run the gold retains a negative bias, a scenario which is confirmed by the four-hour and daily technical indicators. Nevertheless, a rally in the nearest future is more probable than a dip. If the Dec 23 high at 1,185 is surpassed, the metal will have a good opportunity to test a cluster of resistances at 1,200, created by the 200-hour SMA, monthly PP and the down-trend.

Wed, 24 Dec 2014 08:04:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.