Note: This section contains information in English only.

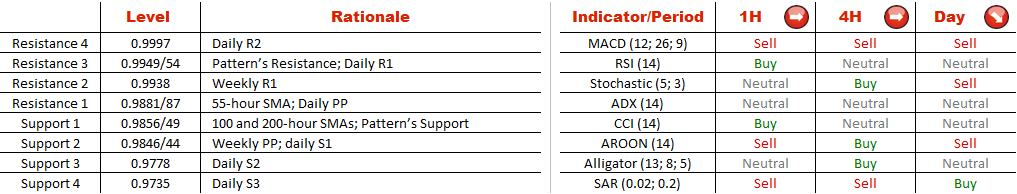

The Australian dollar has approached the lower boundary of the rising wedge pattern, mostly reflecting strength of its Canadian counterpart. At the moment the pair is testing this trend-line. If it successfully surpasses this demand area, reinforced by 100 and 200-hour SMAs, then we can expect the Aussie to drop down to daily S3 at 0.9735 in the long-term. This scenario is supported by daily technicals. At the same time, short-term studies suggest the currency pair to move sideways before commencing a bearish break-out. Distribution of long and short positions changed a little from our last report on this currency pair, as it stands at 45% and 55%, respectively.

The Australian dollar has approached the lower boundary of the rising wedge pattern, mostly reflecting strength of its Canadian counterpart. At the moment the pair is testing this trend-line. If it successfully surpasses this demand area, reinforced by 100 and 200-hour SMAs, then we can expect the Aussie to drop down to daily S3 at 0.9735 in the long-term. This scenario is supported by daily technicals. At the same time, short-term studies suggest the currency pair to move sideways before commencing a bearish break-out. Distribution of long and short positions changed a little from our last report on this currency pair, as it stands at 45% and 55%, respectively.

Fri, 14 Nov 2014 14:50:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.