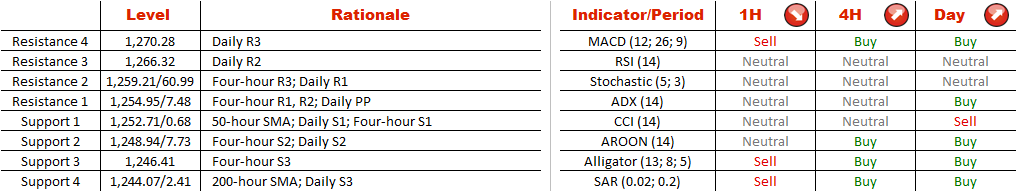

Now the most traded metal is likely to bounce off its 50-hour SMA that has recently prevented a drop below $1,250 per ounce. This view is bolstered by market players who are bullish on the bullion in 60% of cases.

Note: This section contains information in English only.

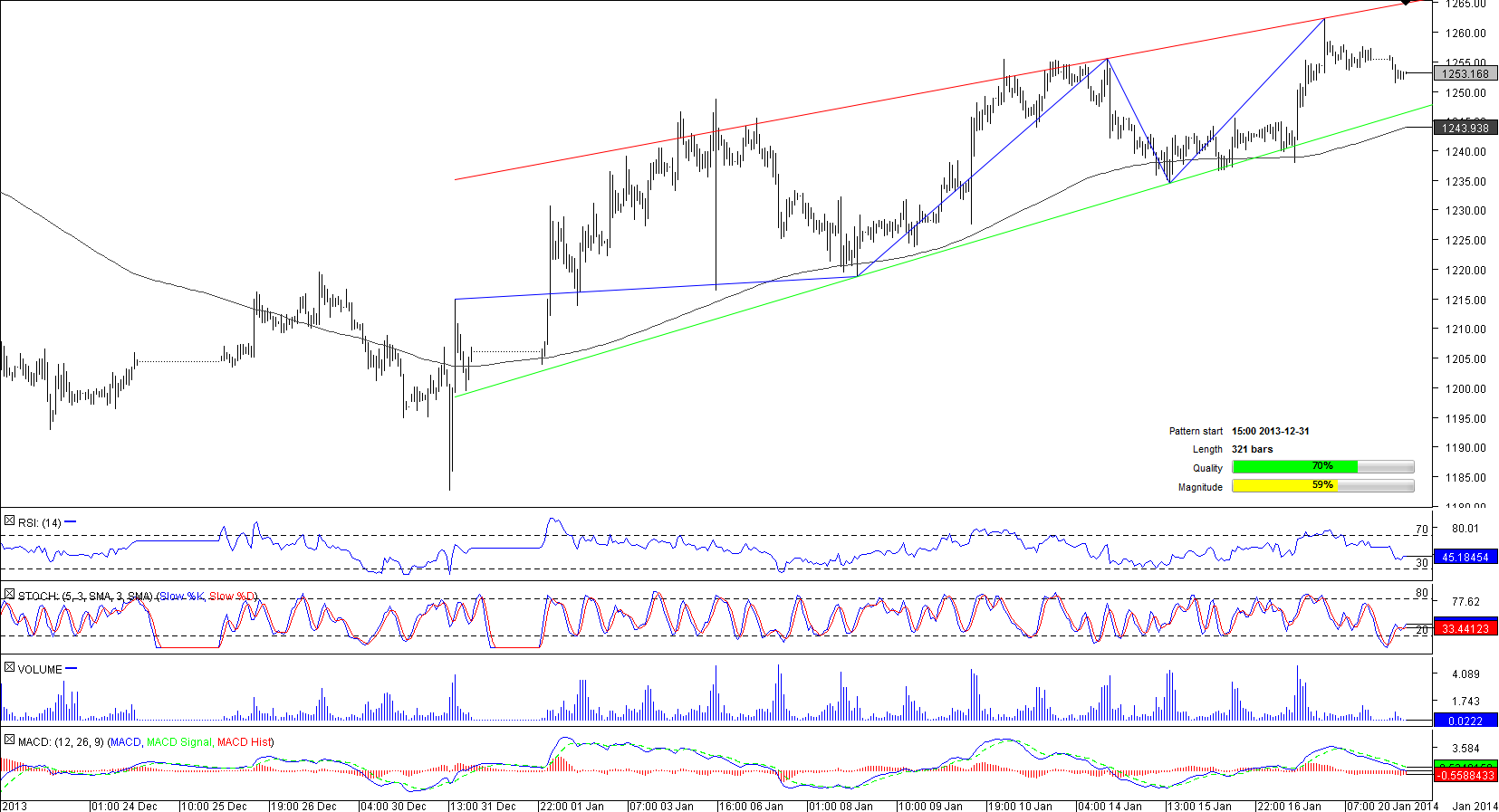

Having plunged to more than a five-year low of $1,182.52, gold reversed its trend and started to shape a rising wedge pattern in the very end of December. The yellow metal has been vacillating between the pattern's trend-lines for more than 320 hours and in mid-January the precious metal managed to approach almost a one-month high of $1,262.49.

Having plunged to more than a five-year low of $1,182.52, gold reversed its trend and started to shape a rising wedge pattern in the very end of December. The yellow metal has been vacillating between the pattern's trend-lines for more than 320 hours and in mid-January the precious metal managed to approach almost a one-month high of $1,262.49.

Now the most traded metal is likely to bounce off its 50-hour SMA that has recently prevented a drop below $1,250 per ounce. This view is bolstered by market players who are bullish on the bullion in 60% of cases.

Tue, 21 Jan 2014 07:09:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Now the most traded metal is likely to bounce off its 50-hour SMA that has recently prevented a drop below $1,250 per ounce. This view is bolstered by market players who are bullish on the bullion in 60% of cases.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.