Technical indicators on aggregate point at depreciation of the pair on 30M and 4H time horizons. Short traders could focus on daily pivot (PP)/20 bar EMA at 0.9272, Bollinger band at 0.9264, pattern's support at 0.9255, daily pivot (S1) at 0.9248 and pattern's low at 0.9239.

Note: This section contains information in English only.

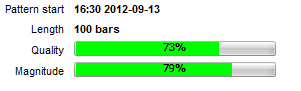

USD/CHF has formed a Triangle pattern on 1H chart. The pattern has 73% quality and 79% magnitude in the 100-bar period.

USD/CHF has formed a Triangle pattern on 1H chart. The pattern has 73% quality and 79% magnitude in the 100-bar period.

Technical indicators on aggregate point at depreciation of the pair on 30M and 4H time horizons. Short traders could focus on daily pivot (PP)/20 bar EMA at 0.9272, Bollinger band at 0.9264, pattern's support at 0.9255, daily pivot (S1) at 0.9248 and pattern's low at 0.9239.

Tue, 18 Sep 2012 06:51:50 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 0.9239. Currently the pair is trading at 0.9279. The SWFX market sentiment is bullish as 74% of traders hold long positions on the pair expecting its appreciation. In addition, 52% of all pending orders in the range of 100 pips from current market price are buy orders. Long traders could focus on Bollinger band/Fibonacci (23.6% of move since 13th of September at 0.9281/83, daily pivot (R1) at 0.9297, Fibonacci (38.2%) at 0.9310 and daily pivot (R2)/200 bar SMA at 0.9322/24.

Technical indicators on aggregate point at depreciation of the pair on 30M and 4H time horizons. Short traders could focus on daily pivot (PP)/20 bar EMA at 0.9272, Bollinger band at 0.9264, pattern's support at 0.9255, daily pivot (S1) at 0.9248 and pattern's low at 0.9239.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.