Note: This section contains information in English only.

Wed, 25 Jul 2012 14:20:16 GMT

Source: Dykascopy Bank SA

© Dukascopy Bank SA

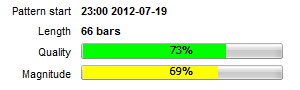

EUR/JPY has stabilized after sharp drop at the end of last and beginning of the current week and has formed a Double Bottom pattern on the 1H chart. The pattern has 73% quality and 69% magnitude in the 66-bar period.

The pattern started when the pair began depreciating on 19th of July at 96.719 and slowed down at 95.000. Pattern's resistance band is at 95.238; support band is around 94.200. The SWFX market sentiment shows that 60% of traders expect recovery of the pair. Technical indicators on aggregate suggest a bullish outbreak on the 1H outlook indicating that the pair will be trying to breach pattern's resistance. Long traders could set the first target at the pattern's resistance band at 95.239. If this level is breached next target could be at the last week close price at 95.465.

Technical indicators on aggregate point at depreciation of the pair on 1D outlook indicating that we might see a pullback or even a transformation to rectangle pattern. Short traders should focus on 94.854 and 94.533 which proved to be very strong support/resistance levels in the recent days. If these levels are breached next target would be at pattern's support level at around 94.200.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.