Traders' Sentiment

Note: This section contains information in English only.

"I don't think the euro bounce is going to be long-lasting. The downside risks are considerable "

"I don't think the euro bounce is going to be long-lasting. The downside risks are considerable "

Traders' Sentiment

Mon, 18 Jun 2012 07:24:37 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Jose Wynne, Barclays Capital (based on CNBC)

Pair's Outlook

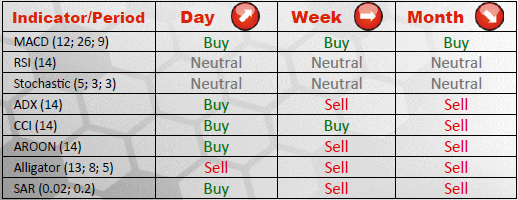

The Euro has been strengthening for the last five trading days and seems to be capable of additional appreciation, given that most of daily indicators are bullish for EUR/USD. Accordingly, the currency pair may advance up to 1.2936/99 in the medium tem, but should be capped by this area in a longer term perspective. Supports, on the other hand, are situated at 1.2660/31 and at 1.2532/15.

Traders' Sentiment

Distribution of opened positions among longs and shorts is equal on EUR/USD, as each of the types constitutes 50% of the market, even though the 17-nation currency is the most popular relative to its major counterparts. The similar situation is observed with orders placed on the pair, since the amounts of buy and sell orders are the same.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.