Traders' Sentiment

Note: This section contains information in English only.

"A lot of the shorts on the euro are still being covered, but no one is making fresh euro longs ahead of Sunday. No one wants to take that risk"

"A lot of the shorts on the euro are still being covered, but no one is making fresh euro longs ahead of Sunday. No one wants to take that risk"

Traders' Sentiment

Fri, 15 Jun 2012 07:06:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- RBS Securities (based on CNBC)

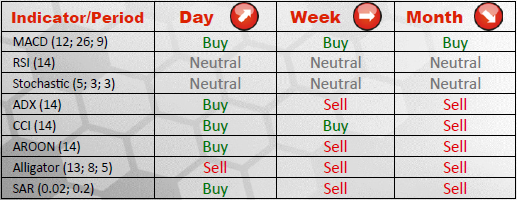

Pair's Outlook

EUR/USD slacks off its speed as the pair approaches an initial resistance located at 1.2660/74, which, in conjunction with 1.2746, should be capable of containing near-term rallies. In an unlikely scenario, when these levels are breached, the outlook will still remain bearish, as long as a key area at 1.2831/93 is intact. Supports at 1.2565 and at 1.2514, on the other hand, should prevent dips from extending further.

Traders' Sentiment

The stance of SWFX market participants remains largely unchanged since the last report, since both bullish and bearish traders constitute nearly equal shares of the market, despite the Euro being by far more popular than the U.S. Dollar. Situation with orders placed on EUR/USD is similar, as the portion of buy orders is 51%, while sell orders make up 49% of the total amount.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.