Traders' Sentiment

Note: This section contains information in English only.

"The recovery in the euro is being driven by expectations that one, Greece will vote for a pro-bailout party at this Sunday's election and two, that the European authorities will step in with euro bonds/more ECB support if Italy gets in more trouble and sees its bond yields surge to unsustainable levels."

"The recovery in the euro is being driven by expectations that one, Greece will vote for a pro-bailout party at this Sunday's election and two, that the European authorities will step in with euro bonds/more ECB support if Italy gets in more trouble and sees its bond yields surge to unsustainable levels."

Traders' Sentiment

Thu, 14 Jun 2012 18:20:44 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Forex.com (based on MarketWatch)

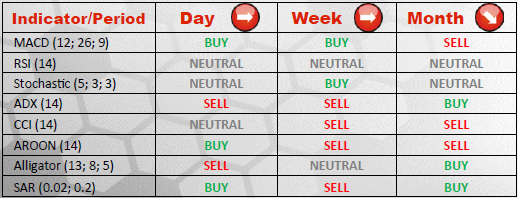

Pair's Outlook

Bullish recovery in EUR/JPY added to gains today as the Eurozone annual CPI figures came in line with analysts' expectations, suggesting the macroeconomic conditions are stabilizing in the region.. If bullish trend to continue further, the pair is likely to test the 101.42 level (Initial resistance line) and 102.08 (R1 Weekly). A breakout here would expose 103.74/53 (55-day ma; R1 Monthly).

Traders' Sentiment

The share of market participants holding long positions changed as 64% of traders are bullish whereas 36% of traders expect the pair to deteriorate further. Within 100 points from the present market price, 64% of investors anticipate eye an appreciation of the Euro against Japan's Yen.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.