© Dukascopy Bank SA

"The SNB is under intense pressure to appear rock-solid in its determination to defend the limit as any hint of indecision would be seen as an invitation to markets to bet on a further appreciation"

- Credit Suisse Group AG (based on Bloomberg)

Pair's Outlook

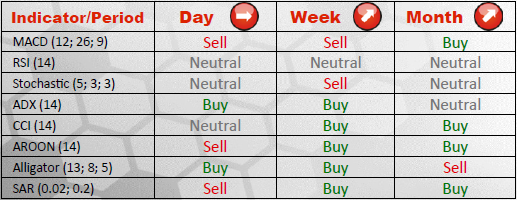

USD/CHF has faltered ahead of 0.9637, but should be able to renew its bullish advancement, as the weekly and monthly outlooks for the pair remain positive. Once 0.9637 is breached, the price will aim for 0.9720, then 0.9776. Supports, on the other hand, currently are at 0.9602, 0.9563/56 and 0.9512/0.9497, limiting possible dips, which may by triggered by closure of long positions.

Traders' Sentiment

The stance of SWFX liquidity consumers towards USD/CHF is unchanged since the previous report. Most of positions (63%) are bullish, while bearish ones form 37% of the market. The disposition of orders, however, is quite different, as 61% of them are sell and 39% are buy orders, implying increased chance of the sentiment changing if the pair moves upwards.

© Dukascopy Bank SA