Traders' Sentiment

Note: This section contains information in English only.

"There's a bit of short-covering in the euro for now, in case there are any new measures coming out from the euro zone. But it's still a sell on rallies"

"There's a bit of short-covering in the euro for now, in case there are any new measures coming out from the euro zone. But it's still a sell on rallies"

Traders' Sentiment

Tue, 05 Jun 2012 07:12:28 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Forecast Pte (based on Bloomberg)

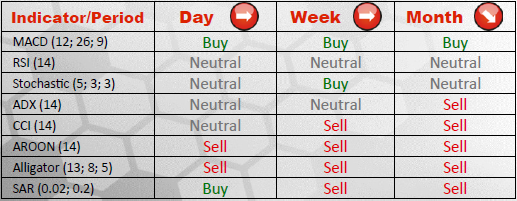

Pair's Outlook

Following an encounter with a downtrend support at 1.2333, EUR/USD has commenced recovery and is currently heading towards 1.2585/90, where the rally is likely to be halted. Additional resistances may be found at 1.2660 and at 1.2773. Given the overall negative outlook for the currency pair, we should observe reignition of bearish sentiment once 1.2585/90 is reached.

Traders' Sentiment

The amounts of bullish and bearish towards EUR/USD currency couple SWFX marketplace liquidity consumers is nearly equal, being 52% and 48% of the market, respectively, even though the 17-nation currency remains as the most popular among its major counterparts, as it has been bought in 74% of cases and sold only 26% of the time.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.