Traders' Sentiment

Note: This section contains information in English only.

"What is more likely to happen though will be that the ECB will finally cave in and will become the lender of last resort"

"What is more likely to happen though will be that the ECB will finally cave in and will become the lender of last resort"

Traders' Sentiment

Fri, 01 Jun 2012 07:47:57 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Royal Bank of Scotland (based on CNBC)

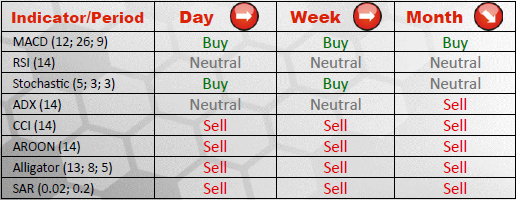

Pair's Outlook

EUR/USD is closing in on 1.2300, which should be capable of holding the currency pair until the end of the current week and trigger some short squeezing. The rally, however, is likely to be shallow, up to 1.2433 or up to 1.2628/60. The long-term outlook remains negative, thus we should observe more bearish behaviour from the price later in June.

Traders' Sentiment

According to SWFX sentiment index, the single European currency remains the most popular among the traders in the marketplace, followed by the Australian Dollar. Accordingly, most of positions opened on EUR/USD are long, constituting 60% of the market, while shorts are in a distinct minority, forming 40% of the total amount of trades.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.