Traders' Sentiment

Note: This section contains information in English only.

"The euro is in an extremely vulnerable position and downside risks are very strong indeed. The Spanish banking crisis has the potential to knock the stuffing out of the euro zone irrespective of the Greek election results"

"The euro is in an extremely vulnerable position and downside risks are very strong indeed. The Spanish banking crisis has the potential to knock the stuffing out of the euro zone irrespective of the Greek election results"

Traders' Sentiment

Thu, 31 May 2012 06:45:34 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Rabobank (based on CNBC)

Pair's Outlook

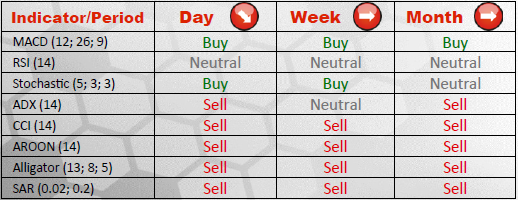

Despite a tough support situated at 1.2433, the currency pair continued to trade lower. At the moment EUR/USD is approaching a subsequent level at 1.2300, encounter with which will result in a short squeeze up to 1.2433. Nonetheless, as suggested by most of the indicators, the overall outlook for the price is negative, as it is currently moving in the direction of 1.1662.

Traders' Sentiment

Judging by the changes in SWFX sentiment index towards EUR/USD, most of market participants reckon the Euro has hit a bottom and is soon about to commence recovery. 61% of traders are bullish and 39% of them are bearish on the pair. On the other hand, 56% of orders placed on EUR/USD are to buy the Euro and 44% of them are to sell it against the U.S. Dollar.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.