Traders' Sentiment

Note: This section contains information in English only.

"It's as if everything starts and ends with Spain. Everyone is talking about Spain, putting Greece's problems on the back burner."

"It's as if everything starts and ends with Spain. Everyone is talking about Spain, putting Greece's problems on the back burner."

Traders' Sentiment

Wed, 30 May 2012 15:57:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Satoshi Okagawa, senior global markets analyst for Sumitomo Mitsui Banking Corporation (based on Reuters)

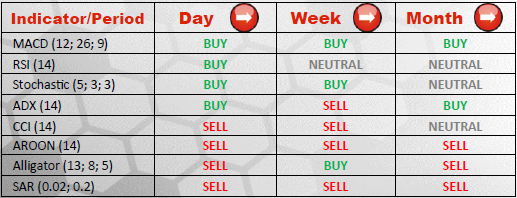

Pair's Outlook

The common European currency continued moving south today as worries over Spain intensified today. With the fundamental factors remaining unchanged, the bearish momentum has a chance to intensify and in this case, initial support level at 98.43 (Initial support line) is likely to be in focus by the bears. Once this level is pierced, 97.73 (Lower Bollinger band; S1 Weekly) and 97.01 (S2 Weekly) are going to be targeted.

Traders' Sentiment

The ratio between the amounts of bullish and bearish on EUR/JPY among SWFX marketplace participants is inclined towards bears as the vast majority of investors (75%) expect the Euro to fall further.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.