Traders' Sentiment

Note: This section contains information in English only.

"The pressure remains on the downside in euro/dollar and any rebounds will be sold into in this environment"

"The pressure remains on the downside in euro/dollar and any rebounds will be sold into in this environment"

Traders' Sentiment

Wed, 23 May 2012 07:09:45 GMT

Source: Dukascopy Bank

© Dukascopy Bank

- Morgan Stanley (based on CNBC)

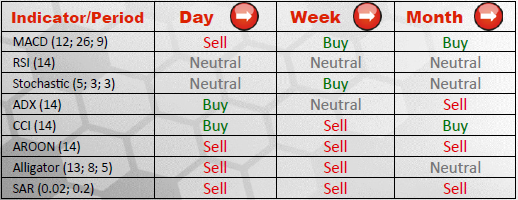

Pair's Outlook

EUR/USD has precipitously sold off to 1.2642/40, where it is currently consolidating, before resuming sliding lower. The next target for the pair is situated at 1.2509, which guards 1.2377 and may become a reversal point, starting bullish waves. Rallies, in case of occurrence, will encounter resistances at 1.2772, 1.2818 and 1.2903/26, thus remaining tepid and unlikely to extend far above the levels indicated.

Traders' Sentiment

According to SWFX traders' sentiment, market participants carry on favouring the single European currency over the US Dollar, since 63% of all the positions held on EUR/USD are long, while 37% of them are short on the pair. On the other hand, only 29% of orders within 100 pips from the current price are to buy the Euro, while sell orders constitute 71%.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.