Pair's Outlook

Note: This section contains information in English only.

"I do not expect that the BOJ would agree on the additional stimulus this time"

"I do not expect that the BOJ would agree on the additional stimulus this time"

Pair's Outlook

Mon, 21 May 2012 19:30:40 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Masafumi Yamamoto, Chief Currency Strategistat Barclays Bank (based on Dukascopy Expert Commentary)

Pair's Outlook

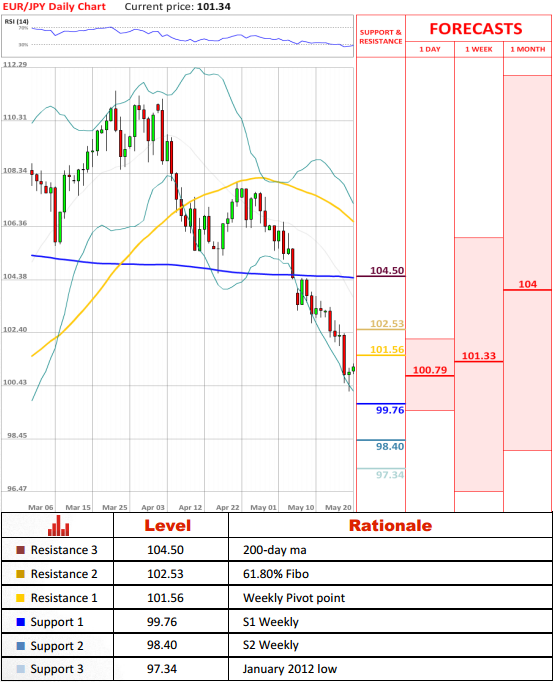

EUR/JPY attempts to recover for the second day, consolidating within the 101.56/14 price channel, after falling for almost 2 consecutive months. In case bullish trend emerges, investors could focus their attention on 101.56 (Weekly PP), a breach of which would expose 102.53 (61.80% Fibo) and 104.50 levels (200-day ma).

Traders' Sentiment

At the moment the number of short positions on the currency pair outweighs the number of long ones, as their portions in the SWFX marketplace are 46% and 54%, respectively. However, within the range of 100 pips from the current price long positions take the lead, exceeding sell orders by 10%, implying the possibility of reiteration of the bullish sentiment in the nearest future.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.