Traders' Sentiment

Note: This section contains information in English only.

"We are entering a consolidation phase with regard to the euro. It will not be known for a while whether Greece will stay in the euro or not with Greek election a few weeks away"

"We are entering a consolidation phase with regard to the euro. It will not be known for a while whether Greece will stay in the euro or not with Greek election a few weeks away"

Traders' Sentiment

Mon, 21 May 2012 06:29:24 GMT

Source: Dukascopy Bank

© Dukascopy Bank

- Bank of Tokyo-Mitsubishi UFJ (based on CNBC)

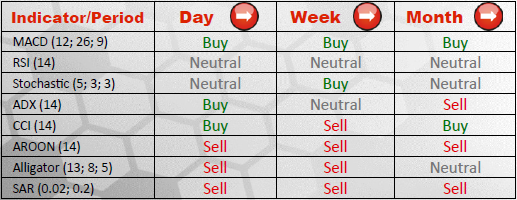

Pair's Outlook

The currency couple is presently undergoing a bullish correction following its precipitous fall from a downtrend resistance at 1.3252. EUR/USD may attempt to test 1.2903/17, but is unlikely to extend gains above this level, which, in turn, will lead to continuation of a bearish move towards 1.2509, en route to a long term target at 1.18.

Traders' Sentiment

According to SWFX Sentiment index, the ratio of bullish market participants to bearish ones remains nearly the same, being 62% to 38%, indicating no change in the share of positions. At the same time the Euro keeps title its as the most popular currency, being preferred to the rest of major currencies in the market.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.