© Dukascopy Bank

"Basically we all know that the BOJ, the Fed and the ECB have no choice but to print more money as lenders of last resort. I see the dollar stuck in a range this quarter, around 80-84 yen"

- Hideki Amikura, Nomura (based on Reuters)

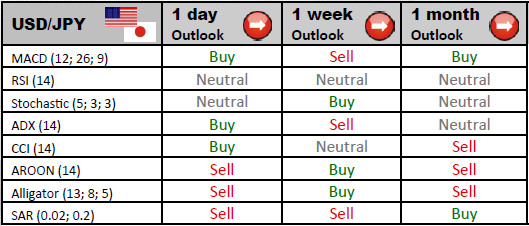

Industry outlook

Even though the downside risk persists and a support at 79.15/78.90 is exposed, the currency pair shows signs of an emerging recovery. As soon as 80.45 will be overcome, the new aim will be set at 82.42.

Traders' sentiment

The overwhelming majority of traders (73%) on USD/JPY have preferred to open long position awaiting the US Dollar to gain in value relative to the Japanese Yen.

Long position opened

Leading market participants, who have entered USD/JPY market with a buy trade, are expecting to close their positions at the key resistances at 80.08, 80.25 and 80.49.

Short position opened

Bearish traders will pay attention to the key support levels in order to close their deals. The primary forecast target is 79.67. If the pair erodes this level, then it might rebound from S2 of 79.43 or S3 of 79.26.

© Dukascopy Bank