© Dukascopy Bank SA

|

"We will continue to closely monitor the market with caution so we can act in a timely and appropriate manner when needed."

- Japan's Finance Ministry for International Affairs (based on Reuters)

Industry outlook

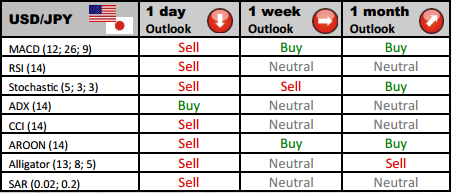

USD/JPY slipped lower, piercing the 80.00 psychological mark and the lower boilinger band at 80.27 respectively. Therefore, the pair is likely to continue trading in a bearish trend, thus the next strong support traders could face is located around 78.35/50 (200-day MA).

Traders' sentiment

Traders are single-minded on USD/JPY currency couple, as 74.74% of them are presently holding long positions, at the same time only 27% of them keep on staying short.

Long position opened

The price might rebound from the first resistance level at 80.22, so major dealers are planning to close some of their long positions near this level. Subsequent goals for bulls are 80.63 and 80.87.

Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 79.57. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 79.33 and at S3 of 78.92.

© Dukascopy Bank SA