© Dukascopy Bank SA

|

"It makes sense that the pound has performed relatively well of late given the shift in interest rate expectations, but it appears to be overshooting now, particularly as the UK is still in recession."

- BTM-UFJ (based on Reuters)

Industry outlook

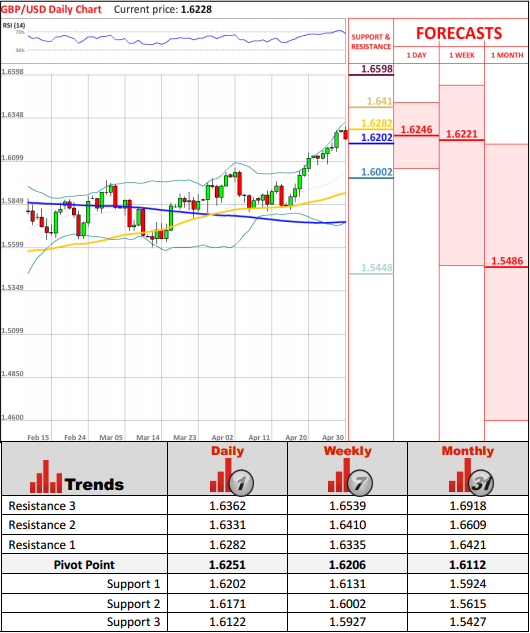

GBP/USD is still trading above the 1.6200 mark—the highest level since 2008 and yesterday it managed to hit the 1.6300 level. Yet, the pair might retrace at least to the 1.6150/1.6180 levels after such solid movement as from the fundamental point of view, the British pound has no basis for keeping such a strong

value compared to the US dollar.

Traders' sentiment

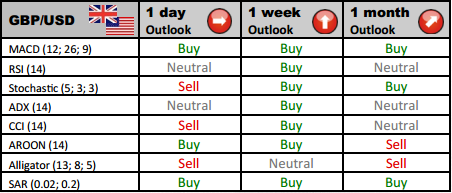

The Cable is currently oversold, since the absolute majority of market participants (70.99%) have decided to short the pair, expecting it to reiterate a bearish reversal.

Long position opened

Largest brokers set a new long position target as a break of 1.6282 is an encouraging bullish sign en route to 1.6331. If the uptrend remains, the third target for intraday trading will be 1.6362.

Short position opened

Major FX traders expect the price to test the initial support level at 1.6202. The breakout of this line will pave the way for the price to test S2 at 1.6171 and S3 at 1.6122.

© Dukascopy Bank SA