Note: This section contains information in English only.

Mon, 30 Apr 2012 10:02:54 GMT

Source: Dukascopy Bank

© Dukascopy Bank

"Watching Spain now is exactly like watching Ireland around October 2010 before Ireland was forced into its bailout"

- Roubini Global Economics (based on Bloomberg)

EUR/JPY slumped lower last week as the market aims to stick to the near-term support level at 106.49. It might approach the 55-day MA located and higher Bollinger band around 107.80/99 and a breach here would reiterate a bullish momentum for the pair.

The share of long positions has slightly dropped to 59.9%, leaving the overall bullish stance of traders unaltered after the Spain's loss of the "A" sovereign credit rating.

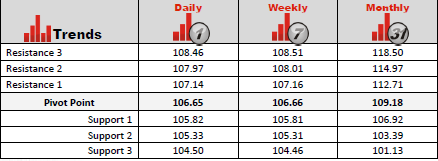

While trading this pair, investors should pay attention to the immediate resistance level at 107.14. If the pair manages to go through this level, further resistances are situated at 107.97 and 108.46.

Bearish traders will pay attention to the key support levels in order to close their deals. The primary forecast target is 105.82. If the pair erodes this level, then it might rebound from S2 of 105.33 or S3 of 104.50.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.