Long position opened

Note: This section contains information in English only.

"There are no real underlying fundamentals that are supporting the euro at these levels. I'm fairly bearish on Spain and the broad euro zone as a whole."

"There are no real underlying fundamentals that are supporting the euro at these levels. I'm fairly bearish on Spain and the broad euro zone as a whole."

Long position opened

Mon, 30 Apr 2012 10:07:45 GMT

Source: Dukascopy Bank

© Dukascopy Bank

- Rochford Capital (based on Bloomberg)

Industry outlook

Last week was positive for EUR/USD, though the next barrier the pair has to test is located near 1.3287/91 zone as the 5-month downtrend and the 8-month channel. There is a high probability that these levels will not be pierced and they will trigger a bearish correction.

Traders' sentiment

The share of short positions has slightly increased after Spain's lost of "A" credit rating, up to 56%, leaving the overall bearish stance of traders unchanged.

Long position opened

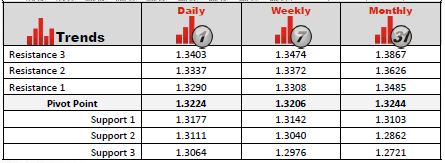

FX market participants have put their take profit orders at the key resistance points of intraday trading. Some of the investors might close their deals at 1.3290 and 1.3337. The highest level is at 1.3403.

Short position opened

Key support for EUR/USD intraday trading is situated at 1.3177. In case S1 is penetrated, traders with short positions are likely put their T/P orders at 1.3111 and 1.3064.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.