© Dukascopy Bank

"To get a higher response in the market, there has to be a creative new twist, like new assets being acquired or a new timeline for reaching the 1% inflation goal"

- Citibank (based WSJ)

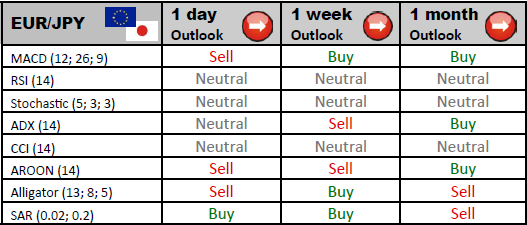

Industry outlook

Bullish momentum has weakened, but should still persist, driving the currency pair upwards. The nearest support is located at 106.33, reinforced by a subsequent level at 105.93. EUR/JPY is anticipated to encounter 108.00 within the next two weeks.

Traders' sentiment

The share of long positions has slightly dropped since yesterday's report, down to 64%, leaving the overall bullish stance of traders unaltered.

Long position opened

Bullish investors should pay attention to the key resistance levels for intraday trading. R1 is situated at 107.66, followed by R2 and R3 at 108.24 and 108.83, respectively.

Short position opened

Bearish traders will pay attention to the key support levels in order to close their deals. The primary forecast target is 106.49. If the pair erodes this level, then it might rebound from S2 of 105.90 or S3 of 105.32.

© Dukascopy Bank