© Dukascopy Bank

[Swiss] "exports will climb in the coming months. However, given the euro area weakness, growth will be muted"

- Credit Suisse Group AG (based on Bloomberg)

Industry outlook

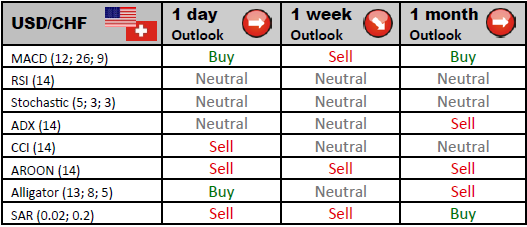

Following a flat movement of USD/CHF just above 0.9066 in the coming days, bullish momentum is expected to be reignited, shifting attention to a resistance at 0.9317/42. Within the next three months the pair might even attain 0.9595.

Traders' sentiment

According do SWFX sentiment index, most of traders (73%) have preferred to acquire the Greenback against the Swiss Franc, anticipating the Dollar to increase in value.

Long position opened

The initial resistance level for the pair is 0.9133. If the price continues increasing, the investors will hold longs until the pair climbs up to 0.9163 or 0.9184.

Short position opened

In case of dips, another rally may start after rebounding from the initial support level at 0.9082. However, assuming that the bearish momentum does not weaken, investors will pay attention to the lower support levels at 0.9061 and 0.9031.

© Dukascopy Bank