© Dukascopy Bank

"The question now is not whether the BOJ could ease on April 27, but what the bank would do in taking further easing steps"

- Norinchukin Research Institute (based on CNBC)

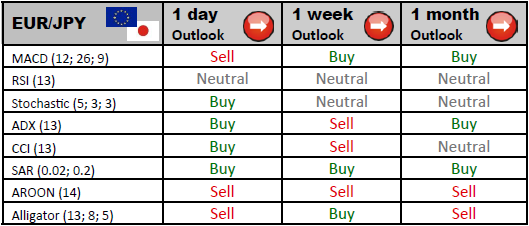

Industry outlook

Considering that EUR/JPY is currently headed towards 105.93/65, where tough supports will be met, we are likely to see the currency pair recovering from there. However, extension of a present dip down to 103.50 may not be ruled out just yet.

Traders' sentiment

The share of bulls has increased up to 66%. Accordingly, the portion of traders who hold short positions on EUR/JPY has dropped down to 34%.

Long position opened

The initial resistance level for the pair is 107.30. If the price continues increasing, the investors will hold longs until the pair climbs up to 107.84 or 108.43.

Short position opened

In case of dips, another rally may start after rebounding from the initial support level at 106.17. However, assuming that the bearish momentum does not weaken, investors will pay attention to the lower support levels at 105.58 and 105.04.

© Dukascopy Bank