© Dukascopy

"The situation surrounding Japan's economy is increasingly severe due to weakening global economic recovery, effects of Thai floods and rapid yen rises"

- Motohisa Furukawa, Economics Minister (based on Reuters)

Industry outlook

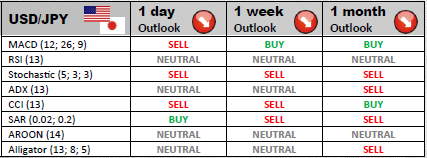

USD/JPY currency couple has penetrated 77.40 and is now headed towards 76.93/87, from where the recovery might commence. While advancing the pair will encounter resistances situated at 79.44, 80.44 and 85.53.

Traders' sentiment

Bulls have improved their situation in USD/JPY market since Friday morning up to 48.63%, but this is not enough to overthrow bears, which still form a majority with 51.37%, even though the Japanese yen is the least attractive currency now.

Long position opened

While trading this pair, investors should pay attention to the immediate resistance level at 77.51. If the pair manages to go through this level, further resistances are situated at 77.89 and 78.51.

Short position opened

Bearish traders will pay attention to the key support levels to close their deals. The forecast targets are 76.89, 76.66 and 76.04.

© Dukascopy