Note: This section contains information in English only.

"There's a refreshed dovish element to the pound since King yesterday. Anything that comes from an official, which lays the door open for possible further QE, takes the shine off the pound."

"There's a refreshed dovish element to the pound since King yesterday. Anything that comes from an official, which lays the door open for possible further QE, takes the shine off the pound."

Thu, 29 Mar 2012 09:33:02 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Mizuho Corporate Bank Ltd. (based on Bloomberg)

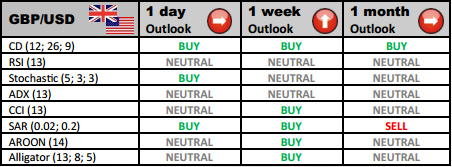

Industry outlook

GBP/USD has bounced off the recent high at 1.5992 without even hitting a psychological level at 1.6000 (the market has not traded above this level since 2008). The pair is likely to slide back to 1.5570 (22nd March 2012 low).

Traders' sentiment

The shares of short positions and long positions on GBP/USD has remained pretty much unchanged since yesterday (71.48%/52% act.) as investors stay bearish on the currency pair.

Long position opened

The immediate resistance level for GBP/USD is expected to be faced by market players at 1.5954. R2 at 1.6020 and R3 at 1.6077 are the next resistance levels that are likely to be tested if the bullish stance holds.

Short position opened

The largest market participants might close their positions around the 1.5831 line. If such scenario takes place, S2 at 1.5774 and S3 at 1.5708 might be targeted next targets if the bearish momentum persists today.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.