Note: This section contains information in English only.

Wed, 28 Mar 2012 08:38:23 GMT

Source: Dukascopy Bank

© Dukascopy

"The yen move is driven by supply and demand before the final exchange-rate fixing of the fiscal year. […] I think we'll start to see some rise in demand to buy JPY.

- Mizuho Corporate Bank Ltd. (based on Bloomberg)

Industry outlook

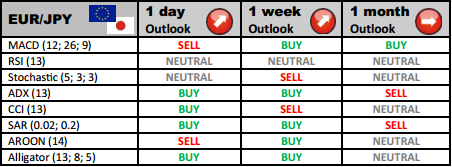

EUR/JPY is holding bullish impetus while recovering from the 20-day average at 108.97. However, the pair could still face a fierce resistance at the 111.57 level once it is there, and if it fails to break through, the 2-month low at 106.44 will be the next target as the bearish momentum will loom.

Traders' sentiment

Traders' sentiment remains turned bearish today on EUR/JPY due as the gap between the short (43.93%) and long (56.07%)positions widened.

Long position opened

Leading market players with buy positions on EUR/JPY could partially close their positions near the first support line at 110.31. If the bullish uptrend strengthens, further resistance levels at 111.69 and 112.13 will become the next intraday targets.

Short position opened

Forex traders might anticipate the currency pair price to plunge to the first support level at 110.31 if the market changes its tone to bearish. When this line is pierced, a path to S2 at 109.87 and S3 at 109.40 will be cleared.

© Dukascopy

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.