Note: This section contains information in English only.

"The euro area's debt crisis is "almost over"

"The euro area's debt crisis is "almost over"

Wed, 28 Mar 2012 08:31:42 GMT

Source: Dukascopy Bank

© Dukascopy

- Italian Prime Minister Mario Moni (based on Bloomberg)

Industry outlook

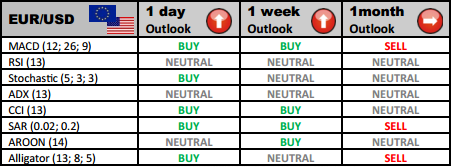

The pair is attempting to advance further and it is likely to test the 7-month high at 1.3457. There is a good chance that EUR/USD will fail to go further and in the middle-term will retrace to 1.3291 and further to 1.3237.

Traders' sentiment

Bearish tone among the market participants eased compared to yesterday, though the number of sell-orders (55.36%) still outnumbers buy-orders (44.64%) as investors expect the pair to move downwards.

Long position opened

Traders placing long positions on EUR/USD should closely watch the first resistance level located at 1.3411. In case it is successfully pierced, the upcoming resistance levels at 1.3411 and 1.3437 might be tested.

Short position opened

In case of a bearish scenario, the initial support line would lie at 1.3291. If the price falls further, the pair is likely to move to the next support levels at 1.3265 and 1.3218, where an attempt of bullish reassertion might take place.

© Dukascopy

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.