Note: This section contains information in English only.

Tue, 27 Mar 2012 11:25:23 GMT

Source: Dukascopy

© Dukascopy

"The Fed's stance to support the economic recovery through policy easing and adding liquidity to the market is helping boost sentiment"

- Shinkin Asset Management Co. (based on Bloomberg)

Industry outlook

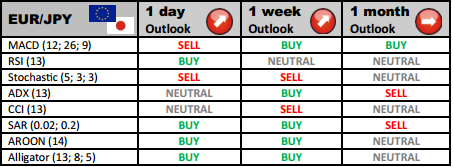

EUR/JPY rallied above the 110 level and eased the risks of bearish reversal. However, the market could face a fierce resistance at the 111.57, and if it holds, it might move downwards to the 2-month low at 106.44.

Traders' sentiment

Traders' sentiment remains mixed on EUR/JPY due to the fact that the shares of long and short positions narrowed the gap, being 48 and 52 per cent, respectively.

Long position opened

Forex traders with long positions on EUR/JPY might be willing fix profits at the initial resistance line of 111.16. If the bullish uptrend strengthens, further resistance levels at 111.71 and 112.71 might tested next.

Short position opened

Leading market players expect the currency pair price to approach the initial support level at 109.61. A breach of this line is likely to expose further support levels at 108.61 and 108.06 respectively.

© Dukascopy

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.