© Dukascopy Bank

"For the first time in months, Japan managed a trade surplus and that suggests that maybe the Japanese economy is in better shape than some had feared"

- Western Union Co. (based on Bloomberg)

Industry outlook

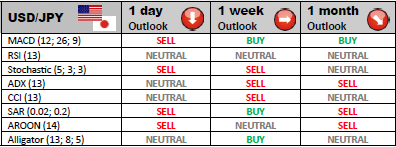

Support at 82.25 did not manage to underpin the pair, which is now trying to form a base near 81.87/67. In case the latter level is breached, USD/JPY is likely to decline to 81.09 or even 80.13. Rallies are contained by 83.02 and 83.40 for now.

Traders' sentiment

Most of market participants (74%) presently are staying long on USD/JPY, waiting for the US Dollar to appreciate relative to the Japanese Yen.

Long position opened

Investors should pay attention to the identified with the help of the standard pivot point method resistance zones, as they might be useful during intraday trading. The initial resistance level is at the level of 82.85, whereas R2 and R3 are situated at 83.39 and 83.83, accordingly.

Short position opened

Bearish traders will pay attention to the key support levels to close their deals. The forecast targets are 81.87, 81.43 and 80.90.

© Dukascopy Bank