© Dukascopy Bank

"The debt crisis is by no means over given the negative growth/budget deficit dynamics in play, but the LTROs appear to have bought the euro zone some time"

- Brown Brothers Harriman & Co. (based on WSJ)

Industry outlook

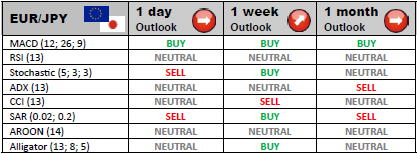

Being that a resistance at 108.75 proved to be impenetrable for EUR/JPY for now, the pair is likely to sell off to 106.90 (200 day ma). Additional support is provided by 106.78 and 106.02. Despite this temporary weakness, EUR/JPY is bullish in the long-term until it reaches 111.57.

Traders' sentiment

The ratio between the amounts of bullish and bearish on EUR/JPY SWFX marketplace participants is unchanged since the last week - 52% to 48%.

Long position opened

Investors should pay attention to the identified with the help of the standard pivot point method resistance zones, as they might be useful during intraday trading. The initial resistance level is at the level of 108.41, whereas R2 and R3 are situated at 108.87 and 109.29 accordingly.

Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 107.53. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 107.11 and at S3 of 106.65.

© Dukascopy Bank