© Dukascopy Bank

"Europe is in a real debt crisis, which is very difficult and painful to overcome"

- Thomas Jordan, SNB Chairman (based on Bloomberg)

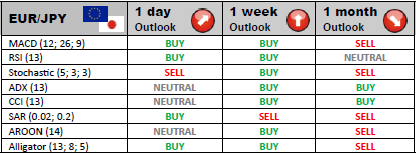

Industry outlook

As long as EUR/JPY currency pair remains above 107.01 (200 day ma), the outlook is positive. The initial goal for the price lies at 109.51, being followed by 110.18. Nonetheless, present bullish momentum is expected to fade ahead of 111.57.

Traders' sentiment

Since the amounts of bulls and bears are nearly the same, traders' sentiment is neutral. 49% of traders are currently staying long and 51% are staying short on the pair.

Long position opened

Leading market participants who have entered EUR/JPY market with a buy trade, are expecting to close their positions at the key resistances at 109.03, 109.61 and 110.48.

Short position opened

Bearish traders will pay attention to the key support levels in order to close their deals. The primary forecast target is 107.58. If the pair erodes this level, then it might rebound from S2 of 106.71 or S3 of 106.13.

© Dukascopy Bank