Note: This section contains information in English only.

Wed, 15 Oct 2014 07:21:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"With the ECB cutting interest rates and honing in on quantitative easing, the SNB will have no choice but to extend the timeframe of its currency cap against the euro."

- Moody's Analytics (based on Bloomberg)

Despite intensive selling the last few days the rising support line (Aug 17 and Sep 4 lows) remains intact. Therefore, the outlook for USD/CHF is still positive, with the immediate obstacle standing at 0.9569 and a more serious threat to the bullish perspective at 0.97. The latter resistance is mainly formed by the monthly R1 and 2014 peak, meaning it is the key to even higher levels, such as the 2013 high at 0.9840.

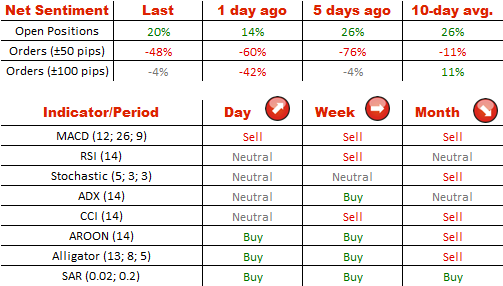

Apparently, yesterday's performance of USD/CHF encouraged the Dollar-bulls, being that the share of longs went up from 57 to 60%. At the same time, the gap between the buy (48%) and sell (52%) orders placed 100 pips from the spot price came to naught.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.