© Dukascopy Bank

"The euro could target 90 yen within this year, but for now, everyone is underweight euro and covers short positions whenever there is good news about Europe"

- Citibank (based on WSJ)

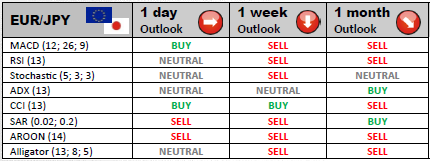

Industry outlook

Rally of EUR/JPY is gaining momentum, suggesting a further recovery of the pair. Being that 98.30 has been already overcome, the next target lies at 100.45/77. However, in the long run the currency pair is expected to decline to 94.92.

Traders' sentiment

The overwhelming majority of market participants remain long on EUR/JPY. 70% of trades are bullish, whereas only 30% of al the positions held are short.

Long position opened

Bullish investors should pay attention to the key resistance levels for intraday trading. R1 is situated at 99.23, followed by R2 and R3 at 99.66 and 100.43, respectively.

Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 98.03. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 97.26 and at S3 of 96.83.

© Dukascopy Bank