© Dukascopy Bank

"While indicators point to some improvement in overall [US] labor market conditions, the unemployment rate remains elevated"

- FOMC (based on Bloomberg)

пЃ® Industry outlook

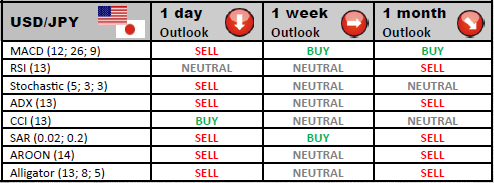

A breach of 77.00 is likely to trigger further sell off. At the moment USD/JPY is heading toward initial support zone at 76.65/50, while a subsequent area is at 76.22/15. In case supports do not withstand bearish momentum, marks such as 74.45 or 73.90 may be reached.

пЃ® Traders' sentiment

USD/JPY pair is presently neutral, since the portion of long and short trades is nearly equal. Bullish market participants constitute 49.26% of the market, while bearish ones form 50.74%.

пЃ® Long position opened

While trading this pair, investors should pay attention to the immediate resistance level at 77.44. If the pair manages to go through this level, further resistances are situated at 78.02 and 78.31.

пЃ® Short position opened

Bearish traders will pay attention to the key support levels in order to close their deals. The primary forecast target is 76.57. If the pair erodes this level, then it might rebound from S2 of 76.28 or S3 of 75.70.

© Dukascopy Bank