© Dukascopy Bank

"The dollar is being bought as a refuge"

- Mizuho Securities Co. (based on Bloomberg)

пЃ® Industry outlook

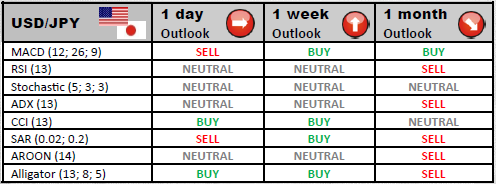

USD/JPY has come through a key resistance at 78.06 and is now en route to 78.47. Should the pair climb even higher it might encounter 79.04 (200 day ma) and 80.00 (55 week ma). Supports, on the other hand, may be found at 77.34/29, 77.15/12 and 76.22.

пЃ® Traders' sentiment

The difference between the amount of traders with long positions and traders with short positions has widened since yesterday. Currently bulls constitute 59.76% of the market, whereas bears form 40.24% of it.

пЃ® Long position opened

The price might rebound from the first resistance level at 78.22, so major dealers are planning to close some of their long positions near this level. Subsequent goals for bulls are 78.38 and 78.65.

пЃ® Short position opened

In case of dips, another rally may start after rebounding from the initial support level at 77.79. However, assuming that the bearish momentum does not weaken, investors will pay attention to the lower support levels at 77.52 and 77.36.

© Dukascopy Bank