© Dukascopy Bank

"Pressure on the BOJ to consider further easing is surging"

- Mitsubishi UFJ Morgan Stanley (based on Bloomberg)

пЃ® Industry outlook

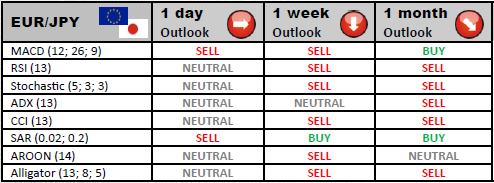

As long as resistances at 102.49, 102.55 and 104.72 are not breached EUR/JPY is not anticipated to show a sustained bullish momentum. Therefore the initial target stays at 100.77, while a level of 99.92 should be approached next.

пЃ® Traders' sentiment

Even though the Euro is not the most popular currency anymore, the vast majority of market participants (88.43%) still holds bullish trades on EUR/JPY, making it the most overbought pair, while only 11.57% of traders are bearish.

пЃ® Long position opened

While trading this pair, investors should pay attention to the immediate resistance level at 102.24. If the pair manages to go through this level, further resistances are situated at 102.61 and 103.04.

пЃ® Short position opened

Major dealers are planning to partially close their short positions if the pair touches upon the first support level at 101.44. However, if the bearish impetus proves to be strong enough, some of the positions could be squared off at S2 of 101.01 and at S3 of 100.64.

© Dukascopy Bank