Pair's Outlook

Note: This section contains information in English only.

Pair's Outlook

Tue, 18 Dec 2012 15:55:45 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"Effectively the board brought forward a potential rate cut in February to the December meeting," NAB economists said in a client note. "This means a fresh case has to be made for yet another cut in February."

- National Australia Bank (based on The Wall Street Journal)

Pair's Outlook

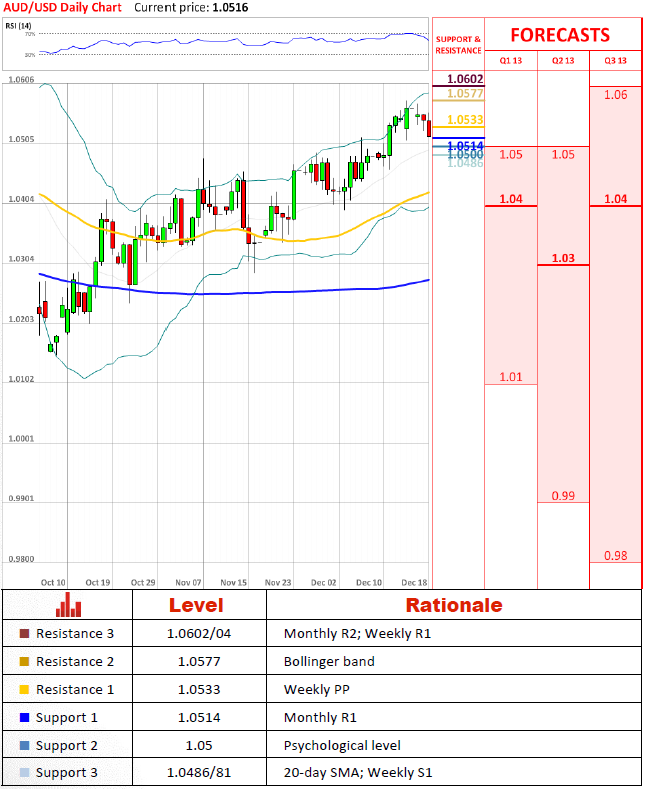

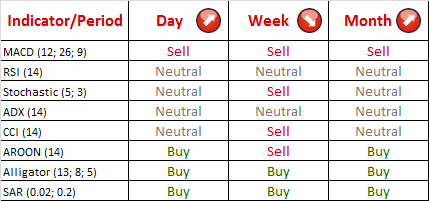

Pair has been depreciating for a second day in a row and at the moment is being supported by monthly R2 at 1.0514. Pair should remain above 1.05 for some time more, but market consensus is that the pair should return below 1.05 as fast as it breached this important psychological level. This probability is supported by the readings of technical indicators on the weekly horizon.

Traders continue perceiving aussie as the much weaker currency in the pair as 72% of all open positions on the pair are to go short. On surprising fact is that pending orders are perfectly evenly distributed between long and short traders.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.