Note: This section contains information in English only.

Mon, 17 Dec 2012 16:24:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"Kiwi was bolstered early by a strong gain in the New Zealand dollar against the yen in response to the Japanese election result but it has since trimmed its gains."

- ANZ Bank (based on The Wall Street Journal)

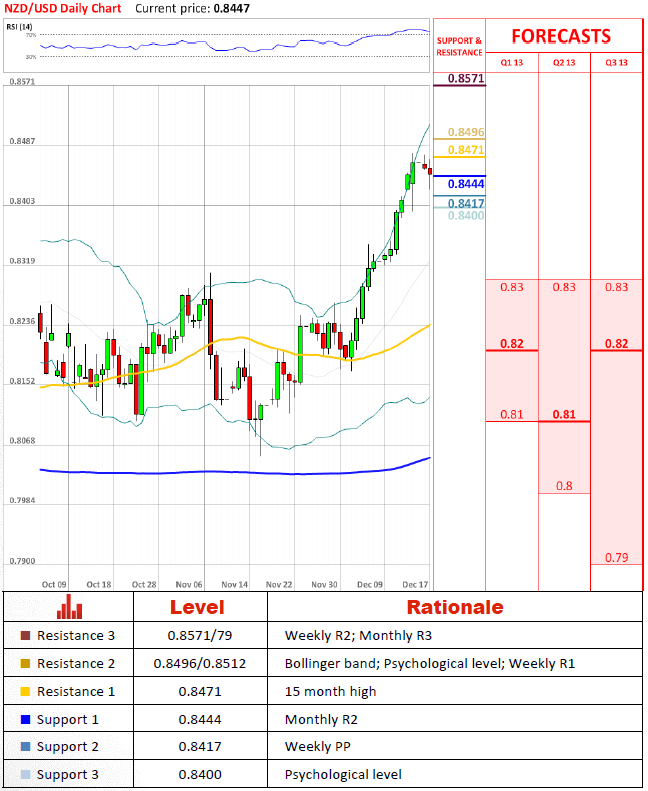

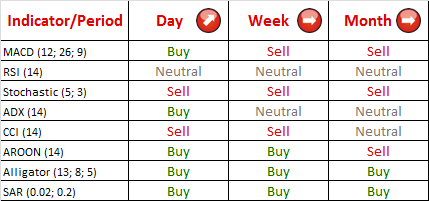

Pair started the week trying to continue the rally it started 11 trading days earlier, but received a bearish impetus from 15 month high from 0.8471 and dipped al the way to weekly PP at 0.8417 where it received bullish impetus and pushed pair above monthly R2 at 0.8444. Short term outlook is fairly positive, but lack of strong positive signals and negative signals from MACD and the Stochastic indicator in medium and long terms raise some doubts if pair will manage to advance closer to 0.85.

Market sentiment on the pair changed just marginally—1% of traders have started holding long positions, but majority of market participants (73%) hold short positions on the pair. Majority of pending orders to go long remain rather stable at 59% as well.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.