Note: This section contains information in English only.

"The election result means there's potential for more economic stimulus in Japan. That would weaken their currency, and see more inflows into the Australian dollar. We also have the Bank of Japan (BOJ) meeting on Thursday, so it will be interesting to see where they will go, now there's been a change of government - they'll be under immense pressure.''

"The election result means there's potential for more economic stimulus in Japan. That would weaken their currency, and see more inflows into the Australian dollar. We also have the Bank of Japan (BOJ) meeting on Thursday, so it will be interesting to see where they will go, now there's been a change of government - they'll be under immense pressure.''

Mon, 17 Dec 2012 16:23:51 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- HiFX (based on The Australian)

Pair's Outlook

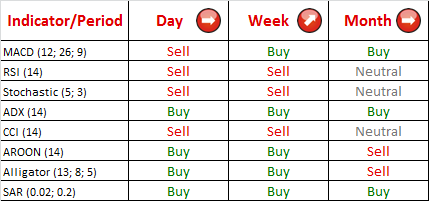

Pair started the week at 111.06 with the intention to advance even further, but did not manage to reach even the 2012 high at 111.43 and was dragged down to 110 JPY were it found some support and has been hovering slightly below Bollinger band since then. It seems that it is just the beginning of a longer bearish dip as the Stochastic and the RSI on daily and weekly charts send strong sell signals suggesting pair is up for correction after prolonged rally.

Traders' Sentiment

Even after Japan's parliament elections nothing has changed in the market perception during the weekend—63% of traders continue to hold short positions on the pair and 72% of traders have posted long (pending) orders on the pair.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.