Traders' Sentiment

Note: This section contains information in English only.

"The discussion on (negative) interest rates is what started the slide in the euro in the last 24 hours and the Bundesbank report has just compounded that."

"The discussion on (negative) interest rates is what started the slide in the euro in the last 24 hours and the Bundesbank report has just compounded that."

Traders' Sentiment

Fri, 07 Dec 2012 15:44:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Bank of New York Mellon (based on Reuters)

Pair's Outlook

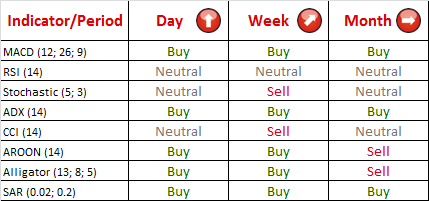

Pair continued its yesterdays dip, but was halted and kicked back up by 20-bar SMA at 106.08. However, weekly PP at 106.70 did not allow the pair to pick up any higher. Technical indicators send a very strong aggregate buy signal, suggesting that mentioned SMA might kick in some momentum in to pair and we could see additional attempt to reach new high early next week.

Traders' Sentiment

As week closes up to the end, market mood keeps going closer to the equilibrium as the ration between bears and bulls in the market is 52% to 48% respectively. However, in the new week bears might regain a significant part of the market as 60% of pending orders are to go short.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.