Traders' Sentiment

Note: This section contains information in English only.

"The key is the speed with which the Bank of Japan will print money. Expectations might already be too high, given yen shorts are close to six-year highs and the implied inflation rate is 1.3 percent."

"The key is the speed with which the Bank of Japan will print money. Expectations might already be too high, given yen shorts are close to six-year highs and the implied inflation rate is 1.3 percent."

Traders' Sentiment

Wed, 05 Dec 2012 16:33:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Credit Suisse (based on Reuters)

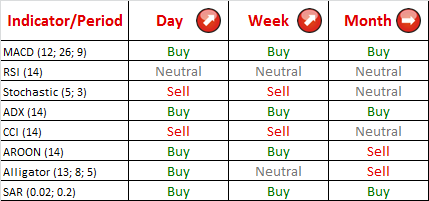

Pair's Outlook

At some point pair was up by 75 pips today, but gave up the pace slightly before the first major resistance at 108.13 and has been range bound between 106.5 and 108 JPY for the past week. Technical indicators suggest pair will step up some more, however, it is rather important that both, on daily and weekly perspective, the Stochastic indicator sends sell signal implying pair has reached the limit of its upper potential.

Traders' Sentiment

Market participants switched sides completely for the second time this week as at the moment 63% of traders hold short positions on the pair. However, 60% of pending orders are to go long suggesting we might see one more major swing in market moods.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.