Note: This section contains information in English only.

Thu, 29 Nov 2012 14:58:26 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"The pricing side looks quite healthy which is very significant given that we not only saw a rally yesterday but also this morning into the auction .Clearly demand is very strong, you could almost say flamboyant."

- Commerzbank (based on Reuters)

Pair's Outlook

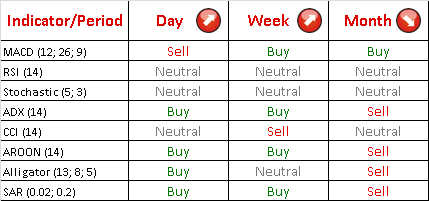

The uptrend, which started yesterday successfully managed to continue, and at the particular moment the EUR/JPY currency pair is slowly approaching the monthly R2 at 107.43, which is expected to slow down the prevailing rally. In case it Is breached, then the price is very likely advance until the next resistance level at 108.30 (weekly R1). Moreover, the overall indicator outlook shows a bullish signal, therefore supporting the current bullish tendency.

Traders' Sentiment

Despite the prevailing downtrend, traders at SWFX market have slight uptrend expectations, as 57% of traders hold long positions and 43% of traders hold short positions. As for pending orders, the distribution is rather neutral, since 49% of traders ordered to buy and 51% ordered to sell the Euro.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.