Note: This section contains information in English only.

"It looks as though Greece wants to pursue a buyback at some point between now and Dec. 13. We don't quite know how much that's going to contribute and it looks as though the IMF is saying part of the deal is contingent upon the success of that buyback."

"It looks as though Greece wants to pursue a buyback at some point between now and Dec. 13. We don't quite know how much that's going to contribute and it looks as though the IMF is saying part of the deal is contingent upon the success of that buyback."

Tue, 27 Nov 2012 16:10:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- National Bank of Australia Ltd. (based on Bloomberg Businesweek)

Pair's Outlook

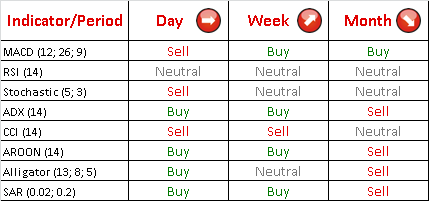

Today the EUR/JPY currency couple experienced a slight bullish correction, however it is not expected to stop the downtrend, which started yesterday. As for now, the price is gradually heading towards the monthly R2 at 107.43, but if it is breached, then the currency pair might face the upper Bollinger band at 108.30, which is expected to reverse the uptrend. Moreover, the overall indicator outlook remains neutral, therefore no significant tendency changes are expected in the upcoming week.

Traders' Sentiment

SWFX market participants have mixed feelings regarding the EUR/JPY currency couple, since 51% of traders hold long positions and 49% hold short positions. As for orders, the situation shows slight downtrend expectations, as 38% ordered to buy and almost 62% ordered to sell the single European currency.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.