Pair's Outlook

Note: This section contains information in English only.

Pair's Outlook

Tue, 27 Nov 2012 13:19:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"Anything that's seen as positive for risk and U.S. equities is still, more likely than not, negative for the U.S. dollar. Progress in fiscal-cliff negotiations would be negative for the dollar"

- National Australia Bank Ltd. (Based on Bloomberg)

Pair's Outlook

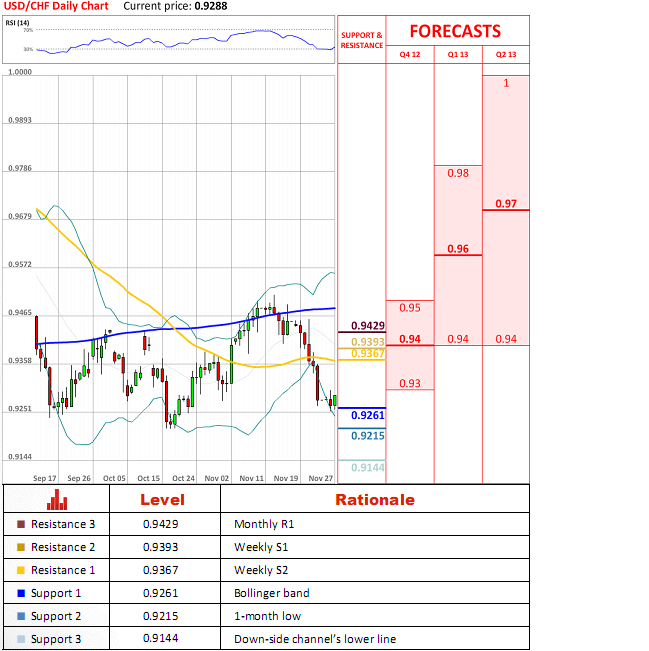

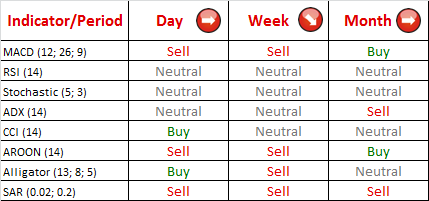

USD/CHF pair slips lower, as yesterday reached 0.9251, the lowest level in one month. The price ignores all signs from technical indicators, which tempts about an oversold zone, as the RSI has value around 30 in both H4 and daily graphs. Current situation demands some correction or a price consolidation in order to continue depreciation process.

USD/CHF pair's sentiments stay constant, as the currency pair experiences new lows. The bullish side still controls 73% of opened positions and the bearish side only 27%. In the pending orders segment the bullish expectations have a slightly higher share of market than bearish, 53% and 47% respectively.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.