Traders' Sentiment

Note: This section contains information in English only.

"Any kind of news in favour of an easing step is increasing yen selling. But I would be sceptical of the depreciation of the yen being sustained much beyond the monetary policy meeting itself."

"Any kind of news in favour of an easing step is increasing yen selling. But I would be sceptical of the depreciation of the yen being sustained much beyond the monetary policy meeting itself."

Traders' Sentiment

Thu, 25 Oct 2012 14:53:22 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Bank of Tokyo-Mitsubishi (based on Reuters)

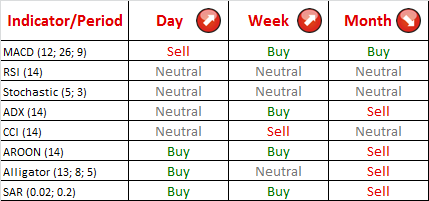

Pair's Outlook

Pair has been appreciating ever since unsuccessful attempt to fall below 103.13/103 area. At the moment it seems it is preparing for one more attempt to advance above 104.55. Although technical indicators suggest pair might succeed this time it should not stay above the mentioned level for long as Bollinger band is likely to stop pairs advance.

Traders' Sentiment

Amount of bears increased by additional 2% since yesterday (7% this week) and is at 58% mark as JPY remains the most sold (in 74% of all cases) major currency across the board. However, share of pending buy orders is at 57% suggesting that bulls might gain majority of the market soon.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.