Traders' Sentiment

Note: This section contains information in English only.

Traders' Sentiment

Fri, 19 Oct 2012 15:56:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"On the Australian dollar, the air above $US1.0400 yet again proved to be thin with good selling interest from a variety of account-types around the figure both late in the Australian session yesterday and offshore."

- National Australia Bank (based on The Australian)

Pair's Outlook

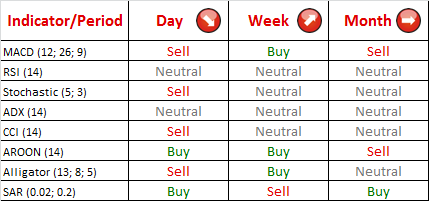

After strong bearish impetus from 1.04 yesterday, pair continued to depreciate today. Taking in to account readings of technical indicators and strength of technical levels, it becomes evident that pairs dip to 1.03/279 is very likely. Dip below this level is rather likely as well, due to rapid gains in last few days which might indicate that pair reached overbought condition.

Traders' Sentiment

After major swing in market sentiment in the beginning of the week, bears continue to occupy majority (60%) of the market. Share of pending buy orders is holding at 54% gauge suggesting that pair has not reached the main trigger level.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.