Traders' Sentiment

Note: This section contains information in English only.

Pair's Outlook

Traders' Sentiment

Tue, 02 Oct 2012 15:49:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"We expect the economy to continue to grow. Our concern is not really a recession. Our concern is that growth will continue but at a pace that's insufficient to put people back to work"

- Ben Bernanke, Fed chairmanSince NZD/USD has lingered near the upper limit of the bullish channel for the last 16 days, it creates suspicion that the pair is forming a rising wedge pattern, downward breakout of which generally occurs more often than the upward one. The nearest support is at 0.8243, but is not deemed capable of halting the possible dip. Level at 0.8181 in this case should be a better estimate of the initial target and is the first possible point of a reversal.

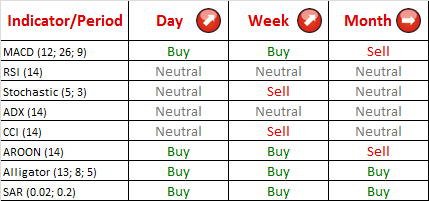

Traders' Sentiment

According to positioning of traders, the pair is widely expected to decline, since an overwhelming majority of market participants continue to hold short positions, namely 72% of the total amount. Distribution between buy and sell orders (43% to 57%, respectively) shows a much more tepid bearish signal.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.